The aerospace and defence industry continues to be a hotbed of innovation, with the conflict in Ukraine driving defence spending and investment, the need to combat emerging technologies such as hypersonics, and growing importance of technologies such as AI and computer vision. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Robotics in Aerospace, Defence & Security: Autonomous control systems. Buy the report here.

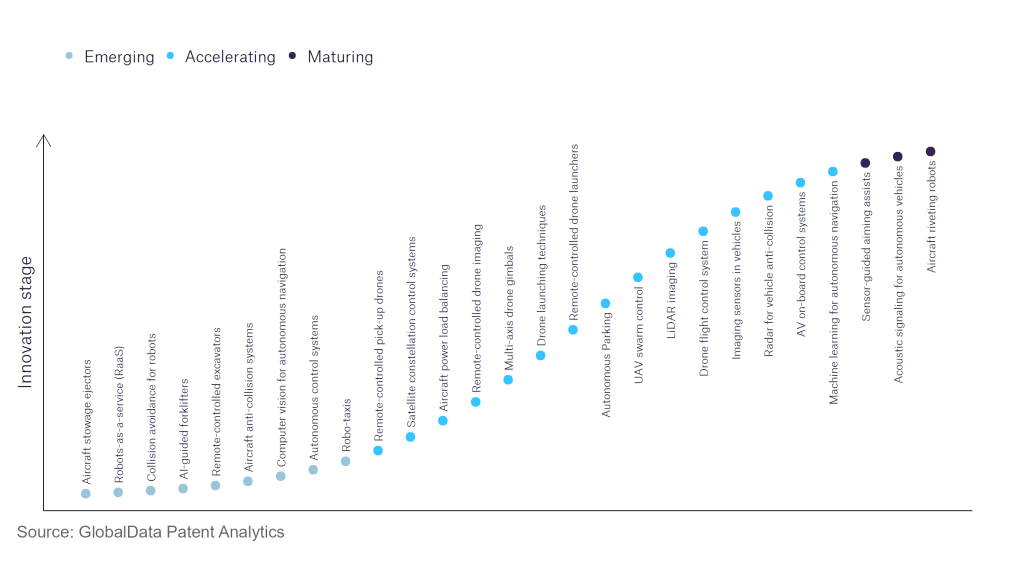

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, collision avoidance for robots, computer vision for autonomous navigation, and autonomous control systems are disruptive technologies that are in the early stages of application and should be tracked closely. UAV swarm control, and drone flight control system are some of the accelerating innovation areas, where adoption has been steadily increasing. A maturing innovation area is sensor-guided aiming assists which are now well established in the industry.

Innovation S-curve for robotics in the aerospace and defence industry

Autonomous control systems is a key innovation area in robotics

Autonomous Control Systems (ACS) are tools that utilise Artificial Intelligence (AI), Machine Learning (ML) as well as data acquisition to provide robots with the capability of operating with little or no human control, even when operating in an uncertain or contested environment.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of autonomous control systems.

Key players in autonomous control systems – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to autonomous control systems

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Baidu | 28 | Unlock Company Profile |

| Mitsubishi Electric | 12 | Unlock Company Profile |

| Robert Bosch Stiftung | 10 | Unlock Company Profile |

| General Motors | 10 | Unlock Company Profile |

| Ocado Group | 10 | Unlock Company Profile |

| Ford Motor | 8 | Unlock Company Profile |

| Huawei Investment & Holding | 8 | Unlock Company Profile |

| Brain | 8 | Unlock Company Profile |

| Intel | 7 | Unlock Company Profile |

| Apple | 7 | Unlock Company Profile |

| Boeing | 6 | Unlock Company Profile |

| Hitachi | 5 | Unlock Company Profile |

| Qualcomm | 5 | Unlock Company Profile |

| Honda Motor | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Baidu is one of the leading patent filers in autonomous control systems, the company has invested heavily in autonomous driving technology and is attempting to increasingly commercialise the technology and achieve mass production in coming years. Baidu is rolling out its technology in China and has developed a number of autonomous taxi systems, which have integrated machine learning and can predict how other road users are likely to act. Another major company in the sector is Mitsubishi Electric which is developing autonomous driving technologies, utilising radar and cameras to enable autonomous navigation. Some other key patent filers in this industry include Robert Bosch Stiftung, General Motors, Ford and Huawei.

In terms of application diversity Ford Motor is the leader, with Huawei and Baidu in second and third positions. By geographic reach, Boeing is top, followed by Hitachi and Ford Motor.

Existing autonomous systems rely on human attention at all times; at least theoretically, however patent filings suggest that the technology is coming which will enable full autonomy and this is the direction that investment is taking.

To further understand the key themes and technologies disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Defence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.