“Incumbents in virtually every industry face disruption from AI, and those that fail to make AI a priority will risk extinction.”

This is the view of business intelligence and analytics firm GlobalData on artificial intelligence (AI), and is a verdict that’s hard to disagree with. But while no company can afford to be a loser in AI, which technology brands are currently leading the AI race around the world?

The answer isn’t a simple one. AI is a theme covering various technology categories, not all of which are led by the same companies. There is healthy variety and competition in the market, with impacts spanning every sector: oil, retail, banking, automotive and more.

Today, Verdict takes a deep dive into the industry picture using GlobalData thematic research to find out which companies are winning the AI race, and how much of a threat China may one day pose to their bottom lines.

The Unusual Suspects

GlobalData estimates that the global AI platform market will be worth $52bn in 2024, up from $28bn in 2019.

In the analysts’ assessment of the data, Big Tech is making a big mark in AI. Almost a dozen tech giants have achieved a noteworthy presence in the field, along with six key disruptors from China and the West.

It’s clear that companies with access to large amounts of data to power AI models are leading AI development. Key groups within AI include GAFAM (Google, Apple, Facebook, Amazon and Microsoft), BAT (Baidu, Alibaba, and Tencent), early-mover IBM and hardware giants Intel and Nvidia.

The six disruptors meanwhile are unicorns and relative newcomers. Highlighted are Chinese AI chipmaker Cambricon, US-UK cybersecurity name Darktrace, British semiconductor company Graphcore, Chinese leader in deep learning and image recognition Megvii, Chinese wearable brand Mobvoi and the Hong Kong-headquartered AI brand SenseTime.

The two Western entities in GlobalData’s disruptor list are Darktrace and Graphcore. The former was founded by Cambridge University mathematicians and US/UK government cyber intelligence experts, backed by in/famous Autonomy founder Mike Lynch – once dubbed “Britain’s Bill Gates”, today a wanted man facing extradition proceedings from the US over the sale of Autonomy to HP in 2011. Darktrace’s original AI tech, the Enterprise Immune System, was supplemented by autonomous response technology, which allowed the system to react to in-progress cyberattacks.

In 2017, Darktrace launched a new business unit, Darktrace Industrial, to fight industrial and supervisory control and data acquisition network threats. Towards the end of 2019, Darktrace introduced Cyber AI Analyst, a new technology that aims to emulate human thought processes. By automating tasks to continuously investigate cyber threats at machine speeds, the proprietary software reduces the average time to investigate threats by 92%. It should be noted though that Darktrace shares recently plunged by 23% over what’s seen as a gap “between promise and reality” regarding its products: and the legacy of Lynch and Autonomy hangs over the company. Several executives at Darktrace, including its founder and CEO Poppy Gustafsson, have previously held roles at Autonomy and at Invoke Capital, Lynch’s VC fund.

The other Western disruptor, Graphcore, meanwhile, has managed to raise over $450m since 2016 from investors including Dell, BMW, Samsung and Microsoft. The investment has helped the company develop its graph-based Intelligence Processing Unit (IPU) technology, which focuses on the massive parallel processing of data from various inputs to outgun previous hardware generations.

The company has started shipping processor cards to Dell, and is hinting at neuromorphic processors down the line. These are chips which use physical artificial neurons to do computations, effectively mimicking the workings of the human brain. They should make it easier and cheaper to deploy deep neural-network based Machine Learning, the mainstream type of true AI today.

The rest of GlobalData’s ones-to-watch, like Mobvoi, are all Chinese companies. Note though that Mobvoi was founded by ex-Google research scientists and is backed by Google itself. A leader in developing voice technology for wearables via its strength in speech recognition, the company has raised over USD$250m and in 2019 it reached unicorn status. Mobvoi is prominent in the consumer hardware space with its Tic line of smartwatches, wireless earbuds and rear-view mirrors for automobiles. The latter offers drivers navigation, instant messaging and voice-controlled infotainment on the road.

China’s SenseTime meanwhile has raised over USD$3.3bn from investors such as Alibaba and SoftBank, valuing it at USD$7.5bn. SenseTime’s range of products and services includes facial recognition, image and video processing, robot sensors and autonomous driving. These tools have applications in financial services, smart cities, security and more. Government support and direct access to China’s vast database of citizens are primary assets, with government contracts representing about two-fifths of SenseTime’s revenues.

Cambricon meanwhile may sound like a Cambridge, UK-based venture, but is actually headquartered in Beijing, China. With backing from the Chinese Academy of Sciences and Alibaba, among others, the AI chip manufacturer is valued at USD$2.5bn. The company filed an IPO prospectus in March 2020 and received the green light from the China Securities Regulatory Commission in June to list on the Star Market, China’s new Nasdaq-like stock exchange. It aims to raise USD$400m from its IPO and spend the proceeds on cloud-based algorithm training and inference and edge computing, all in its aim to become a leader in machine learning – not just in China but the world as a whole.

Finally, one of the most promising – and most controversial – companies is Megvii, which is valued at more than USD$4bn thanks to backing from investors such as Alibaba and Bank of China Group Investment.

Megvii is an image recognition and deep learning company primarily focusing on the Internet of Things (IoT). The company filed for a USD$500m IPO in August 2019, but it did not win approval at a hearing with the Hong Kong Stock Exchange’s Listing Committee in October of the same year.

The filing was undermined by the US government’s decision to put Megvii and several other Chinese technology giants on a trade blacklist, following accusations of involvement in human rights violations against Uighur minorities in China (it later refiled in April this year).

As Verdict recently reported, China’s smart city model is backed by what GlobalData research calls a “highly exportable” package of technologies, including AI-enabled cameras.

The research also starkly states that this model has been honed by technologies used to control Uighurs in Xinjiang, arguably making for an evolution in AI technology borne out of surveillance and oppression.

The China question

Incumbents should always be keeping tabs on the competition, but the fact that most of GlobalData’s vaunted disruptors are Chinese suggests a looming China takeover of the AI sphere. In a cross-theme report predicting which tech unicorns are likely to go public soon, the research company highlights Megvii, SenseTime and four other Chinese AI brands as heading towards an IPO exit: Horizon Robotics, Yitu Technology, CloudWalk and 4Paradigm.

With a total of six unicorns, China leads in GlobalData’s AI IPO predictions. This should come as no surprise given that the country aims to be the world leader in AI by 2030 through very heavy investment. In a 2019 report from the Center for Data Innovation that compared China, the European Union (EU) and the US in terms of their relative standing in the AI economy, China led in data and adoption. But the GlobalData view is to exercise caution over this progress.

“(China’s) advantage in AI adoption was largely due to a strong position in a limited number of AI technologies, such as facial recognition and smart surveillance,” as researchers state in a recent GlobalData AI report. “These are related to the government’s extensive use of surveillance and are unlikely to create benefits across the economy.

“The US and Europe have a sizable lead in terms of access to high-quality talent and research, and the US has the most AI start-ups and a more developed private equity and venture capital ecosystem. Therefore, while China is making considerable investments, the US’s structural advantages may even enable it to extend its lead.”

For now then, Silicon Valley may be able to keep the US leading on the worldwide AI front.

AI-related research is surging

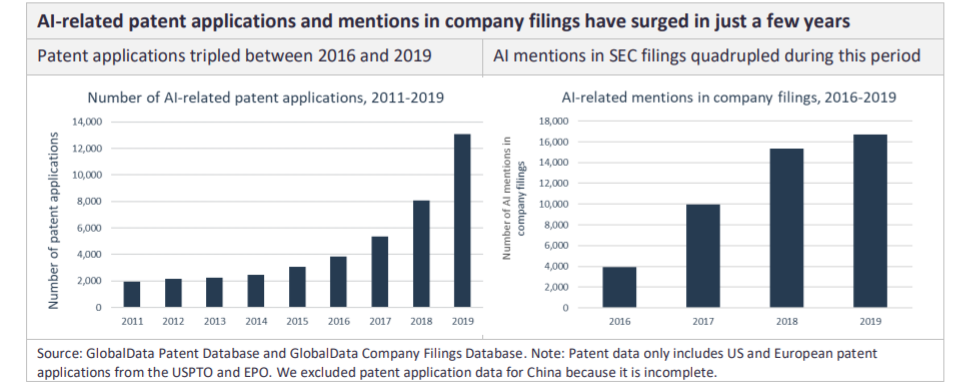

GlobalData’s patent and company filings data illustrate the growing demand for AI. The number of patent applications is booming, with 62% more applications registered in 2019 than the year before. The graph below does not include data from China as it is incomplete, but growth has been even more aggressive in that country. Between 2011 and 2018, the number of patent applications in China grew at a CAGR of 64%, compared to 23% in the US.

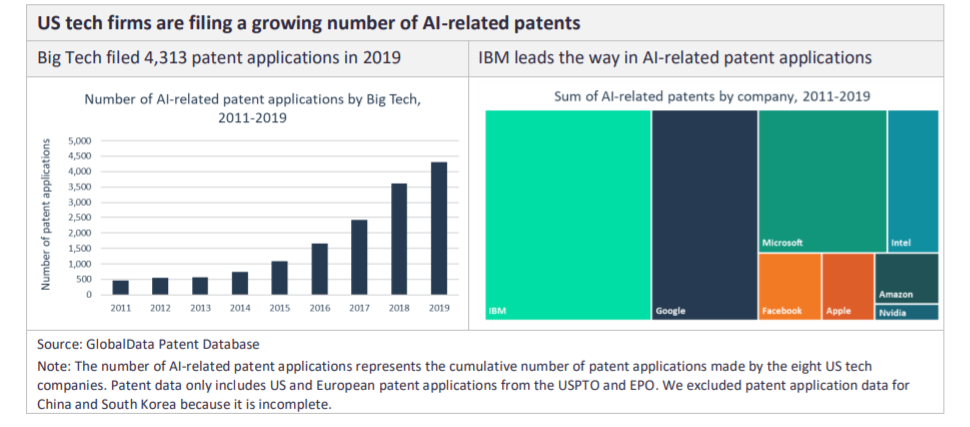

Amazon and Facebook have registered the sharpest increase in AI-related applications between 2011 and 2019. Both recorded a CAGR of about 70% over the period. The data below only includes US and European patent applications: it does not include several highly active companies in APAC, including Samsung, Tencent, LG and Baidu.

While IBM has been relatively inactive in terms of AI-related M&A activity, the tech stalwart has filed 5,660 AI-related patents between 2011 and 2019, with a record number of 1,621 applications in 2019 (almost twice as many as the second-ranking player Google managed in the same year).

A large share of IBM’s patent applications in 2019 focused on natural language processing (NLP). Speech recognition, machine learning, and neural networks have been particularly prominent among Big Tech’s patent applications recently.

The leaders in AI technology

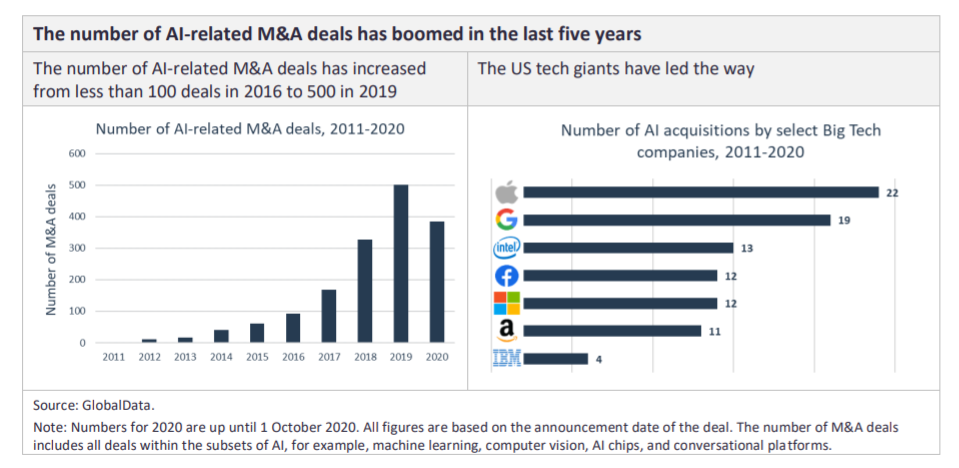

The number of AI-related M&A deals has increased from less than 100 deals in 2016 to 500 in 2019, with Apple leading the US tech giants, followed by the rest of GAFAM alongside Intel and IBM.

The number of M&A deals includes all deals within the subsets of the AI theme. Within these categories the influence of the big brands can vary by mileage.

Amazon, Microsoft, Google and IBM are all leaders in their offerings of machine learning (ML) solutions via cloud services. ML systems can be costly to create in-house, especially as there is a skills shortage, so many businesses prefer to “rent” ML, and other AI services, from the cloud.

All of the leading cloud service providers offer ML solutions that can support individual business needs, and, with demand growing, they are increasingly moving in the direction of providing machine learning as a service (MLaaS).

The four cloud giants are also, unsurprisingly, leading the way in cloud storage for data management in the data science realm. They also have skin in the smart robot game, to boot.

Cloud computing has been a central technology to the development of AI-powered robots, allowing as it does sensing, computation and memory to be managed more rapidly, securely and at scale. The services of Amazon et al combine AI capabilities and infrastructure, giving them the advantage in the field.

Away from the cloud

None of the cloud giants though are leading the way when it comes to the robots being made for factories, care homes and households.

Some of the leading co-bot manufacturers include Teradyne, which owns Universal Robots, and Robotiq, but leading industrial robot makers ABB, Fanuc and Yaskawa have all launched co-bot machines which work alongside humans in the industrial space.

Care robots, which provide care and support to the elderly, disabled and unwell, are still far from mass adoption. However, demand is expected to increase significantly over the next decade, particularly in countries like Japan which have an ageing population and lack sufficient caregivers. As a result, Japanese giants Toyota and Honda have been developing human support robots for many years.

Vacuum and floor cleaning robots account for the vast majority of consumer robots sold, and they offer a range of smart attributes, such as obstacle identification and route planning. iRobot is the leading brand here, thanks to the Roomba’s success.

Google, AI leader in technology

When it comes to perhaps the most visible form of AI in everyday lives, conversational platforms, it is Amazon and Google who rule the roost through the popularity of their smart speakers and voice assistants. Apple follows meanwhile in smartwatches, primarily due to the ecosystem it has developed around the device. It also holds a strong position in hearables with its AirPods. Both devices incorporate the Siri voice assistant.

Google parent Alphabet meanwhile leads in way in computer vision when it comes to automobiles.

AI-powered object detection is a crucial ingredient in autonomous vehicles. More than 40 companies are using sensing technology and advanced algorithms to develop the software for self-driving cars to “see” what’s in their environment. The leader, in GlobalData’s view, is Alphabet’s pioneering Waymo, with more than 10 years of autonomous driving experience behind it to date.

Tesla claims parity with Waymo with its Autopilot, while Uber has made aggressive advancements in recent years. In turn, Baidu’s Apollo open-source platform for AV development has been anointed as China’s platform of choice by the Chinese authorities.

Context-aware computing is also another area of AI where one will find Big Tech casting a long shadow. For Google, Microsoft, Amazon and Facebook, context-aware computing is key to growing and maintaining their customer bases.

Context-aware applications also play a significant role in the automated home, from speakers that know what room you are in, to lights that automatically turn on and off when you enter a room. Google’s Soli offering is a miniature radar chip, powering Motion Sense, that understands human motion. It was incorporated in 2019’s Pixel 4 phone to to allow users to skip songs, snooze alarms and silence phone calls without touching the phone. Google will likely include the technology in the new version of its Nest Home devices, thus bolstering its smart speaker presence.

AI chip technology

Google also leads the way in AI chips. As AI systems need to process massive amounts of data quickly, chip design emphasis has shifted to focus on building microprocessors as systems, made up of multiple components, each of which is designed to perform a specialised task.

Google is a chip leader because of its tensor processing unit (TPU) family of accelerators. Apple, meanwhile, has designed its own chips for quite some time, with the ARM-based A-series on its 14th generation.

Microsoft has re-engineered its servers with FPGA subsystems to achieve the power and flexibility it needs. Finally, Amazon, which has long designed router chips and servers and has its own captive chip company Annapurna, introduced its Inferentia AI chip in 2019.

Neuromorphic chips can handle massive amounts of data and power deep learning applications that use neural networks while consuming less power than conventional processors. IBM, with TrueNorth, and Intel, with Loihi, currently lead the pack in R&D, but face competition, especially from two disruptors vaunted by GlobalData, Graphcore and Cambricon.

Find the GlobalData Thematic Research: Artificial Intelligence (AI) report here.

This article is part of a special series by GlobalData Media on artificial intelligence. Other articles in this series include:

- Japan is leading the way into the elderly-population future. Its solution? AI-powered “Society 5.0” – Verdict

- AI is turning consumer goods brands into tech ones – and customers into R&D – Verdict Retail

- Data shows investment in AI may be peaking – but H20.ai bucks the trend – Retail Banker International

- Financial sectors look to AI in site selection – Investment Monitor