The worsening geostrategic environment is motivating Taiwan’s decision to purchase additional M142 High Mobility Artillery Rockets Systems (HIMARS) as part of a multi-pronged defence strategy, while Japan looks to double its defence spending cap in response to North Korean missile development.

Taiwan sets record $40bn defence budget, purchases HIMARS

The Taiwanese military has decided to purchase additional M142 High Mobility Artillery Rockets Systems (HIMARS) launchers and Army Tactical Missile System (ATACMS) munitions as part of record $40bn annual defence budget.

In its proposed defence budget for 2023, Taiwan has allocated funding for the acquisition of 29 HIMARS, as well as 84 ATACMS surface-to-surface missiles (SSM) and 864 precision guided rockets as part of its largest ever defence budget, currently valued at $21.3bn.

The decision reflects a renewed focus on building a multi-pronged defence strategy amidst the ongoing efforts to enhance strategic deterrence.

Having initially planned to purchase 11 HIMARS launchers and 64 ATACMS missiles, Taiwan was forced to update its planned defence expenditures after original plans to purchase 40 M109A6 Paladin self-propelled howitzers were cancelled in May due to “inadequate production capabilities”, according to Tristan Sauer, land domain analyst at GlobalData.

Despite this late-stage alteration, the 2023 Taiwanese defence budget is in line to deliver a multi-faceted capability set comprised of both advanced platforms and conventional weapons systems to support its asymmetric defence strategy.

Lessons from Ukraine

Following the Russian invasion of Ukraine, Taiwanese defence officials have increasingly pushed for a more nuanced approach to defence procurement.

Analysts highlight the extremely high attrition rate of both advanced and legacy platforms in a high intensity conflict. “The previous efforts to enhance deterrence by acquiring small numbers of advanced platforms and systems have come under increased scrutiny over the past several months,” says Sauer.

“Concerns mount that such an approach would provide ‘priority targets’ for any hostile. Once defeated, these would cripple the military’s capacity to react and respond.”

A paradigm shift has occurred in the Taiwanese procurement priorities, with funding being diverted from large-scale procurement programs to support the development and purchase of more affordable force-multiplier technology. These include tactical uncrewed aerial systems, anti-tank guided missiles and man-portable air defence systems.

HIMARS as asymmetric warfare

Sauer continues: “This renewed focus on asymmetric warfare enablers is only a part of the Taiwanese approach to strategic deterrence, colloquially referred to as the ‘porcupine strategy’.

“As exemplified by the Ukrainian Armed Forces, the ability to maintain asymmetric momentum and outlast a conventionally larger aggressor hinges on the ability of that force to target critical elements of an enemy’s forces with precision strike capabilities in addition to simply outmanoeuvring their offences.

“Indeed, Taiwanese defence officials have understood that their growing asymmetric warfare capabilities must be used in tandem with their more limited number of advanced systems such as HIMARS to remain effective in a protracted high intensity conflict.

“The HIMARS platform and its associated weapons systems have repeatedly demonstrated their effectiveness throughout the war in Ukraine, and the Taiwanese military’s decision to acquire additional units indicates that these strategic similarities are not lost on defence planners.”

Japan defence budget set to surpass $70bn in 2027

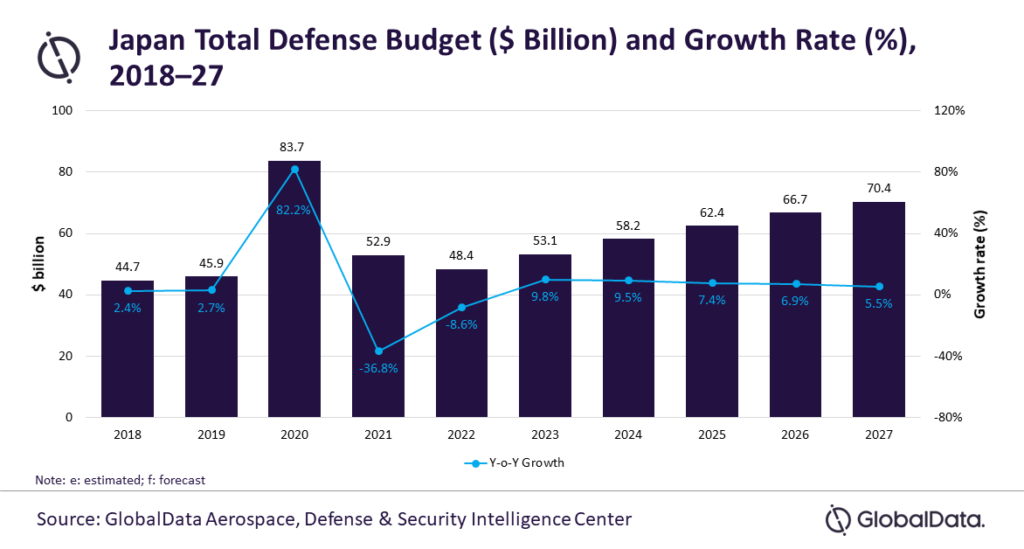

Meanwhile, Japan’s defence spending is set to grow from $48.4bn to $70.4bn in 2027, driven by the need to develop its own defence posture, forecasts GlobalData.

GlobalData’s latest report, “Japan defence Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-2027,” reveals that Japan’s defence spending is anticipated to grow at a compound annual growth rate of 8.4% during 2022-2027.

Threats from North Korea further compounded by China

“The country faces an imminent threat from the North Korea’s nuclear and ballistic missile programmes,” says Abhijit Apsingikar, senior aerospace and defence analyst at GlobalData, “which is further compounded by an increasing Chinese military capability and its reservations against the QUAD security alliance.”

Against this backdrop, in 2020 Japan rolled out a “defence-strengthening acceleration package”, providing $42.5bn in supplementary funding, over and above the $94.1bn initially budgeted for 2020-2021, Apsingikar explained.

Japan is in the process of removing restrictions on defence expenditure, previously constitutionally capped at just 1% of GDP. New plans will make increases that could double expenditure up to 2% of GDP. “This is in line with Japan’s plan to overhaul and modernise its military capabilities to deter any aggression and better prepare to support its allies,” Apsingikar said.

Boons for Japan’s defence industry

Japan’s defence industry is showing signs of strong connections with international partners, according to Apsingikar: “Japan has already signed a deal to cooperate with the UK for the development of a long-range air-air missile and finalised a defence cooperation agreement to co-develop a sixth-generation fighter aircraft.

“With Japan already loosening its export control restrictions and allowing defence exports to 12 friendly countries, including India, it is anticipated to pave the way for a greater level of cooperation between countries and enable more opportunities for the joint design, development, and production of defence equipment in future.”