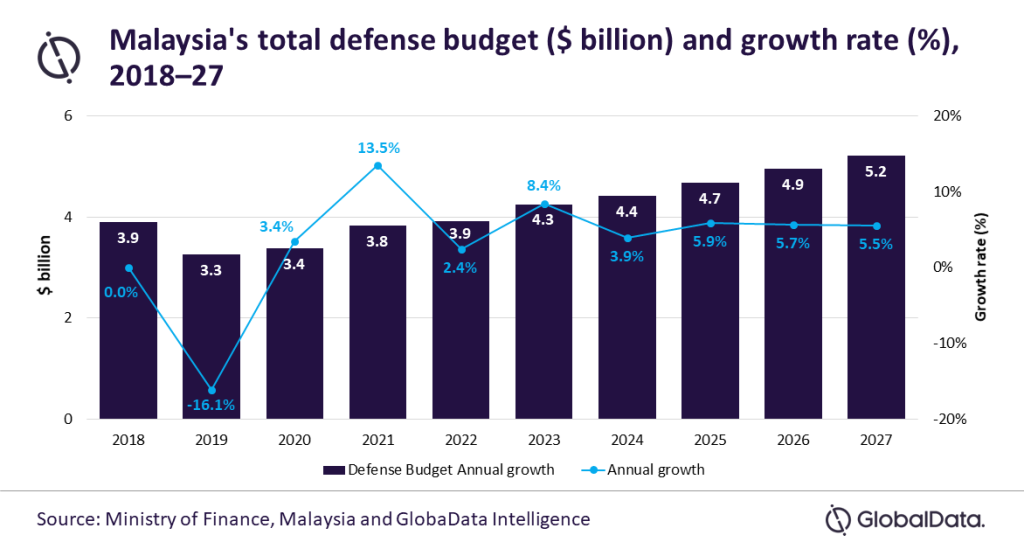

Malaysia’s plans to upgrade its current inventory to deal with the territorial disputes and protect its territory in the South China Sea will result in the country’s defence spending increasing at an estimated compound annual growth rate (CAGR) of 5.3% over the period 2022-2027, according to GlobalData, with the growth primarily driven by Malaysia’s desire to protect its territory in the South China Sea and concerns from the Indo-Pacific.

Across the seas, South Korea’s goal of becoming one of the world’s top five exporters of military hardware is expected to receive a major boost from Hanwha’s acquisition of 49.3% of Daewoo Shipbuilding & Marine Engineering for $1.4bn. Between 2022 and 2032, GlobalData predicts that Hanwa will secure contracts worth over $5.6bn for various categories of artillery, military land vehicles, uncrewed ground vehicles and underwater warfare.

Malaysia’s defence modernisation plans match the heightened expectations of the Indo-Pacific

A positive upturn for Malaysian defence spending has come through parliament over the last few years, with a sizeable jump of 8.4% annual growth for 2023. As a result of Malaysia’s primary emphasis on economic development, the country’s overall expenditure on defence has largely been largely flat, as previous budget reductions have meant the majority of plans to modernize the armed forces have been postponed repeatedly or scrapped altogether.

However, Malaysia’s defence acquisition expenditure has grown 12.5% each year, increasing from $762.8m in 2018 to $1.2bn in 2022, according to the most recent report from GlobalData, “Malaysia Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2022-27”. The increase can be largely attributed to a large number of defence procurements, including naval vessels and military fixed-wing aircraft.

Levers for defence modernisation

Akash Pratim Debbarma, aerospace and defence analyst at GlobalData, commented on the force modernisation challenge facing Malaysia in the context of the Indo-Pacific: “Malaysia is aware of the technological gap in its navy and air force inventory to maintain control over its territories.”

To close this capability gap, Malaysia will require additional warships and potentially land-based anti-ship cruise missiles to establish a credible deterrent in the region and the greater Indo-Pacific. An anticipated boost to the country’s maritime capabilities comes with the country’s purchase of six second-generation patrol-vessel / littoral-combat-ships (SGPV-LCS) and four littoral mission ships (LMS) from the Boustead Naval Shipyard.

Looking to satisfy Malaysia’s requirements for increase air force capabilities, the nation has made ongoing procurements of Turkish Anka uncrewed aerial vehicles and AW139 helicopters to replace its Nuri helicopters soon to be retired. The seas around the Indo-Pacific have seen considerable investment in military deterrence, says Debbarma, “With the Southeast Asian countries increasing their defence budget to deal with the territorial disputes in the South China Sea, Malaysia’s 2022 and 2023 defence budget shows the country’s desire to fulfil its transformational goals while meeting its security requirements. Malaysia’s defence budget is expected to reach $5.2bnin 2027 scaling up many planned and anticipated programmes.”

South Korea as a defence exporter

Following on the news of Hanwha’s buy into Daewoo Shipbuilding & Marine Engineering, Rouble Sharma, defence analyst at GlobalData, voiced the expectation that if the deal between Hanwha and Daewoo Shipbuilding & Marine Engineering goes through without issue, Hanwha will take control of the KDX-IV destroyers’ programme and establish itself as a major player in the South Korean defence industry.

Sharma noted that South Korea has developed a robust export-oriented defence industrial complex, which not only meets domestic defence requirements but also caters to the global defence equipment market, including customers across the Indo-Pacific.

The Korean defence industry has benefited from exports to the United Kingdom, India, Iraq, the Philippines, Peru, and Thailand, as these sales have brought in much-needed foreign currency and boosted the sector’s international reputation. This flow of trade will allow Hanwha to provide a broader selection of products to international customers.

A backdrop of rising defence spending in the Indo-Pacific

The refocus on the defence sector for both Malaysia and Korea comes amid predictions of military defence increase for host of other nations in the Indo-Pacific.

Operations by China’s military forces have motivated its neighbours around the Indo-Pacific to increase the budget for their own defence.

Japan has struck down its historic limits on defence spending, doubling the amount it intends to invest in its military, growing from 1% to 2% of GDP, set to grow from $48.4bn to $70.4bn in 2027, positioning it as the third largest military behind the US and China,

As part of Taiwan’s adoption of a ‘porcupine strategy’ to deter aggression from mainland China, the island nation has proposed its largest ever defence budget for 2023, currently valued at $21.3bn.

GlobalData’s forecast of China’s defence budget increase has a CAGR of 7.2%, from $241.2bn in 2023 to $318.6bn in 2027, with a focus on force modernisation and large-scale projects, including naval vessels increasing China’s presence in the Indo-Pacific.

Singapore has allocated a defence budget of $12.3bn for 2022, an increase of 7.4% over the allocation in 2021; and reflects a CAGR of 3.7% during 2018-2022. Singapore’s force modernisation will drive Singapore’s defence expenditure to $15.8bn in 2027, modernising military equipment, homeland security, and cyber security.

With concerns over China’s regional hegemony and aggression in the Indo-Pacific, between 2018 and 2022, Australian spending on defence acquisition and research and design increased from $8.2bn to $12.2bn, recording CAGR of 10.3%.