Each week, Army Technology’s journalists analyse data on patent filings and grants that illustrate innovation trends in our sector. These patent signals show where the leading companies are focusing their research and development investment, and why. We uncover key innovation areas in the sector and the themes that drive them.

This new, thematic patents coverage is powered by our underlying Disruptor data which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors.

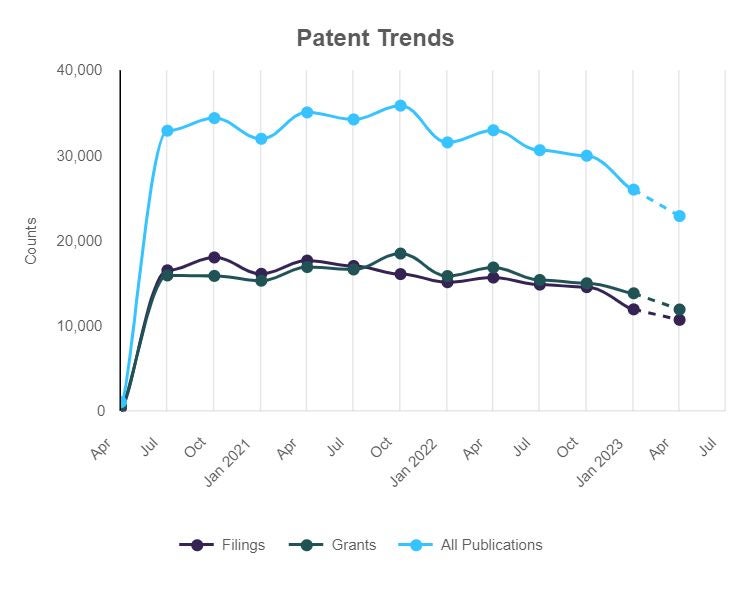

The latest trends from GlobalData’s patent analytics for aerospace and defence indicate a steady decline in the past year, with last quarter (Q2 2023) having the lowest count since the Covid-19 pandemic.

This steady decline saw patents reduce from 30,702 in Q2 last year to 30,049 in Q3, 26,068 in Q4 and 22,958 patents in Q1 2023.

Notably, since the economy emerged from the Covid-19 pandemic, when the count had reached as low as 1,110 in Q2 2020, it increased again and maintained a relatively stable trajectory, moving up and down between 32,032 and 35,933 between 2020-21.

Patent reduction doesn’t complement military-industrial expansion

As the number of patents per quarter indicate the progress of innovation, the steady decline is a curious inconsistency with the conversations and rhetoric coming from the aerospace and defence industry.

With a geopolitical climate dominated by the US-China rivalry – which is also signaled by the geographic distribution, with China claiming 7,071 patents and the US registering 5,746 in Q2 2023 – the reduction does not complement the enormous military-industrial expansion, at least since the start of the war in Ukraine at the end of February 2022.

GlobalData intelligence also tells us that the top five trending themes in this forecast period included the Environment, Robotics, Electronic Warfare, Alternative propulsion and Artificial Intelligence.

The top five sectors are heavily related to the aerospace domain, these include: Aerospace Materials and Structural Components, Aerospace, Military Fixed-wing Engines, Air C4 and Military Rotorcraft Engines.