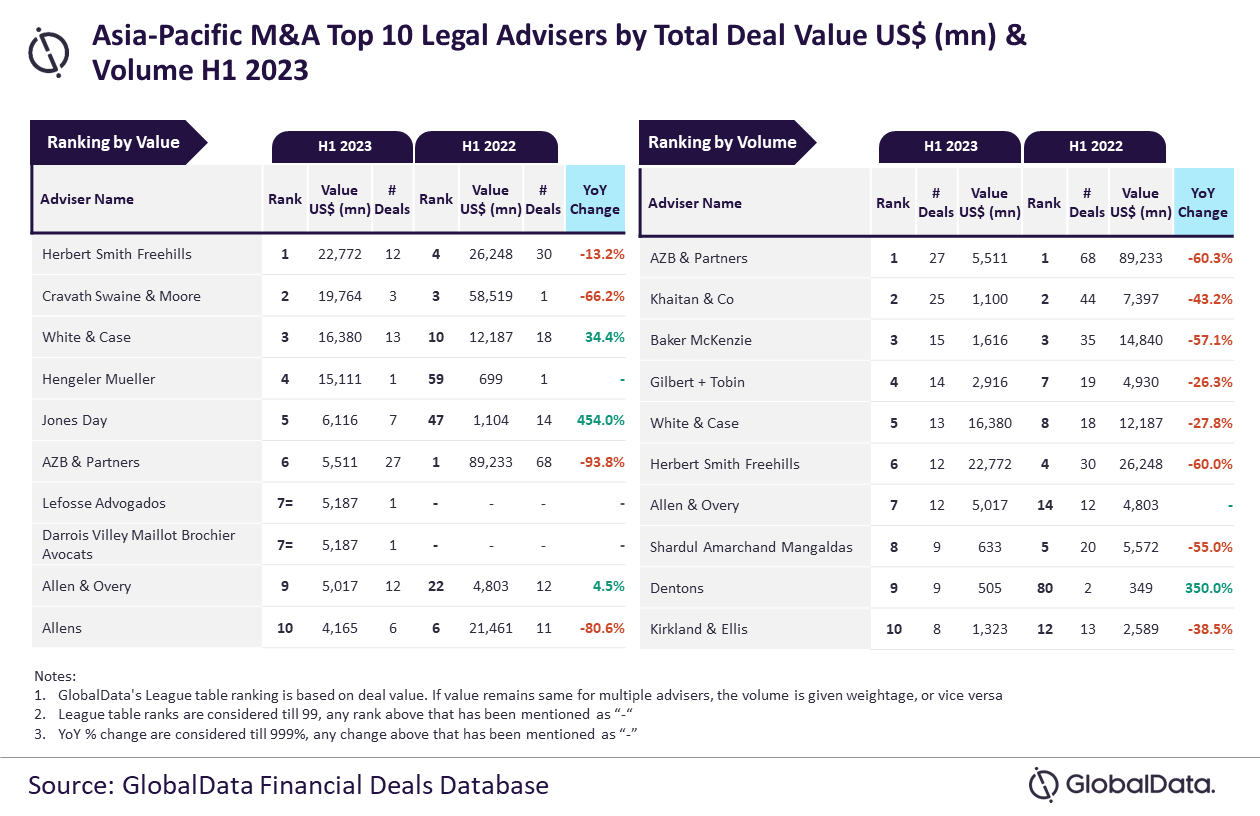

Herbert Smith Freehills and AZB & Partners were the top mergers and acquisitions (M&A) legal advisers in the Asia-Pacific (APAC) region in H1 2023, according to GlobalData’s latest league table.

The leading data and analytics company ranks advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, Herbert Smith Freehills achieved its leading position in terms of value by advising on $22.8bn worth of deals. AZB & Partners led in terms of volume by advising on a total of 27 deals.

“Herbert Smith Freehills advised on three billion-dollar deals [valued at $1bn or more], which also included a mega deal valued more than $10bn,” said GlobalData lead analyst Aurojyoti Bose.

“Moreover, it was the only firm that managed to surpass $20bn in total deal value during H1 2023. Apart from leading by value, it also occupied the sixth position by volume. Interestingly, AZB & Partners, which led the chart by volume, also occupied the sixth position by value.”

Cravath Swaine & Moore came second in terms of value by advising on $19.8bn worth of deals, followed by White & Case with $16.4bn, Hengeler Mueller with $15.1bn, and Jones Day with $6.1 bn.

Runners-up in terms of volume were Khaitan & Co with 25 deals, followed by Baker McKenzie with 15 deals, Gilbert + Tobin with 14 deals, and White & Case with 13 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.