Bartlett Maritime, a non-government corporation established in 2019, has released its plan to resolve the capacity and capability shortfall within the US Navy’s nuclear-powered attack submarine (SSN) industrial base.

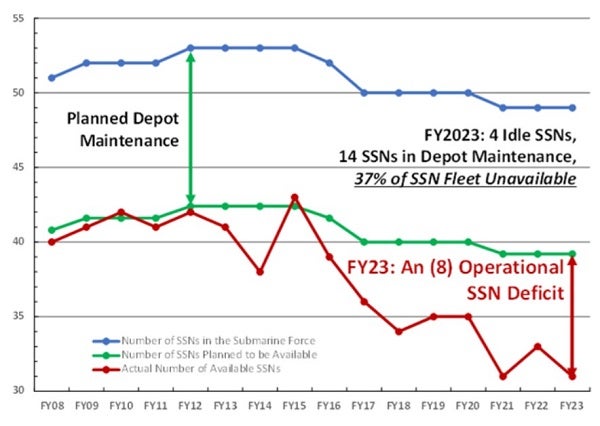

A Congressional Research Service report, published in June, rang alarm bells with its realisation that 37% of the navy’s SSN force is unavailable for operation due to long-term maintenance.

Bartlett Maritime developed its proposal in the last several years, at no cost to the federal government, to resolve what the company calls a “pernicious national security crisis.”

The corporation initially submitted its unsolicited project to the government on 21 January 2022. Since then the corporation has provided an update to this unanswered proposal on 19 June 2023.

In a press release announcing the details of the proposal, the corporation stated that “the plan is mature, readily actionable, affordable and led by experienced shipbuilders and maintainers.”

Expanding industrial capacity of shipyards

Bartlett proposes the construction of new industrial facilities called ‘Component Repair Centers’ (CRCs) – which are near east coast shipyards and logistically connected to support west coast shipyards – to augment existing submarine maintenance.

These include a brownfield and greenfield sites at Lorain and Lordstown, Ohio and a specialised foundry in an unspecified location.

The company explained that the CRCs will take advantage of experienced trade resources and solve the looming funding issue. The new facilities will target bottlenecks in current maintenance processes and shorten typical 2-year SSN overhauls by 100 days each.

Bartlett will put less pressure on shipbuilding schedules for Virginia-class SSNs, the new Columbia-class nuclear ballistic missile submarines (SSBNs), and the next-gen SSN(X), with relief coming six months after the contract is awarded.

Securing the AUKUS agreement

The release of the Bartlett Maritime Plan comes just after the US Secretary of Defense Lloyd Austin’s visit to western Australia, where the USS North Carolina docked for participation in exercise Talisman Sabre.

This marks the first visit by a Virginia-class SSN to the country since the inception of the AUKUS trilateral agreement in which the UK and US will support the development of Australia’s SSN force.

According to GlobalData insight into the US Navy’s force structure, the service currently employs 52 active SSN units: 20 Virginia-class (procured 2004-22), 3 Seawolf-class SSN (1997-98), and 29 Los Angeles-class SSNs (1976) – as well as 18 Ohio-class SSBNs (1981-97).

With concerns, affirmed by the CRS report, decrying the steady decline of operational SSNs continues, then America’s strategy in containing the threat of China on the world stage may be compromised in the short-term until Columbia-class SSBN and future SSNs are inducted.

With the US Navy’s own capacity only stretching to refill its own force structure then observers will question the extent to which the AUKUS agreement will ensure an effectual deterrence in the Indo-Pacific theatre.