GlobalData's latest report unveils China's strategic plan to allocate $1.4trn for modernising the People's Liberation Army (PLA) over 2024-2028, with a robust 6.6% CAGR.

The escalating concerns over growing US assistance to Taiwan, territorial disputes in the South China Sea, and regional security alliances have prompted China to focus on bolstering its military capabilities. The planned expenditure reflects the calculated investment in innovation and readiness, aimed at aligning its rising influence on the global stage.

China's strategic emphasis on naval modernisation

China's strategic emphasis on building a formidable blue water navy and establishing a credible nuclear deterrent is evident through its ongoing procurement programmes.

These programmes include the acquisition of a fourth aircraft carrier, the Tang-class nuclear-powered ballistic missile submarine (SSBN), Type 054A frigates, and Renhai-class (Type 055) Destroyers. Once completed, these significant initiatives are expected to reshape regional and global security dynamics.

Debbarma highlights the nations naval evolution as indicative of its strategic foresight, transforming its Navy from a coastal defence force into a potent blue water fighting unit. "China's naval evolution stands as a testament to its strategic foresight and determination to enforce its interests in key regions like the East China Sea, the South China Sea and the Yellow Sea.

A noteworthy transformation is underway as the Chinese Navy shifts from its traditional coastal defence role to a formidable blue-water fighting force. This metamorphosis, driven by a vision of comprehensive maritime prowess, underscores China's intent to reinforce itself as a major stakeholder in calling shots and determining global orders."

The modernisation strategy takes centre stage

In a recent report titled "China's Defense Market Size and Trends, Budget Allocation, Regulations, Key Acquisitions, Competitive Landscape and Forecast, 2023-28," GlobalData, a leading data and analytics company, reveals that the defence budget is set to experience substantial growth.

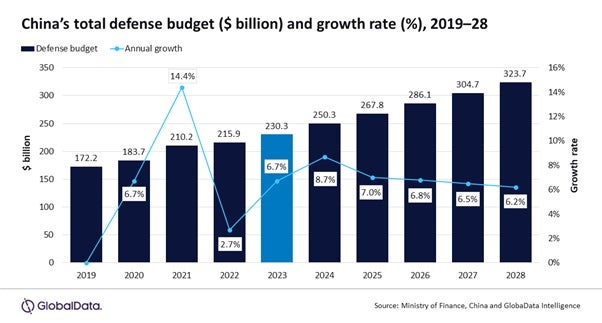

The forecast indicates a robust compound annual growth rate (CAGR) of 6.6%, culminating in a cumulative expenditure of $1.4trn from 2024-2028.

China's defence budget has surged from $172.2bn in 2019 to $230.3bn in 2023, driven by a series of ongoing and planned procurement programmes designed to modernise its defence capabilities.

Akash Pratim Debbarma, aerospace & defence Analyst at GlobalData, underscores the significance of the South East Asian country's financial commitment, stating: "The estimated significant financial commitment of $1.4trn is a clear indication of China's strategic vision. This modernisation initiative isn't just about numbers. It is about a calculated investment in innovation, readiness, and a global role that aligns with China's rising influence."

A self-reliant defence manufacturing industry

In response to restrictions and embargoes imposed by the US and EU on the transfer of foreign defence technology, China has adeptly turned constraints into opportunities. The country has bridged the gap between civil and military industries by nurturing a self-reliant defence equipment manufacturing industry.

Debbarma emphasises the success of China's innovation-driven approach. "The strategic pivot was propelled by China's leverage of non-defence technology for defence applications, bridging the divide between civil and military industries.

This innovation-driven approach not only revived a once struggling defence sector but also elevated China's capabilities to engineer a wide spectrum of cutting-edge defence systems, from fighters and missiles to aircraft carriers and submarines."

As China's defence expenditure intensifies, its calculated investments in modernisation, innovation, and self-reliance suggest its determination to fortify its role in an increasingly complex global landscape.

The evolving dynamics in response to rising tensions, territorial disputes, and strategic alliances emphasise China's ambition to assert its influence and position on the world stage.