In its financial results for the fourth quarter and the whole of 2023, General Dynamics (GD) reported a strong financial position, particularly for its year-end backlog.

“We had a solid fourth quarter, capping off a year that saw growth in all four segments and continued strong cash flow,” said Phebe Novakovic, chairman and chief executive officer.

GD gained quarterly net earnings of $1bn – or $3.64 diluted earnings per share – while revenue grew by 7.5% to $11.7bn over the year-ago quarter.

For the full year, net earnings were $3.3bn, or $12.02 per diluted share. Full-year revenue was $42.3bn, a 7.3% increase from 2022.

Notably, the prime stated its year-end backlog valued $93.6bn, the highest in the company’s history.

Although, the presence of a backlog can have positive or negative implications: a rising backlog may indicate rising sales or increasing inefficiency in the production process. However, given the unprecedented military industrial expansion, not only in the US but around the world, this kind of growth will become more commonplace as we enter a new period of geopolitical contention.

GD’s backlog contracts

In the three defence segments, significant awards in the quarter.

This includes an indefinite delivery/indefinite quantity (IDIQ) contract with maximum potential value of $2.5bn from the Indian Health Service to modernise its electronic health record system.

An IDIQ contract with maximum potential value of $975m to provide mission command training and technical support services to the US Army.

A $395m contract with options having maximum potential value of $840m, for maintenance and modernisation of two US Navy Arleigh Burke-class (DDG-51) guided-missile destroyers.

Another contract with maximum potential value of $420m to provide ongoing lead yard services for the Navy’s DDG-51 programme.

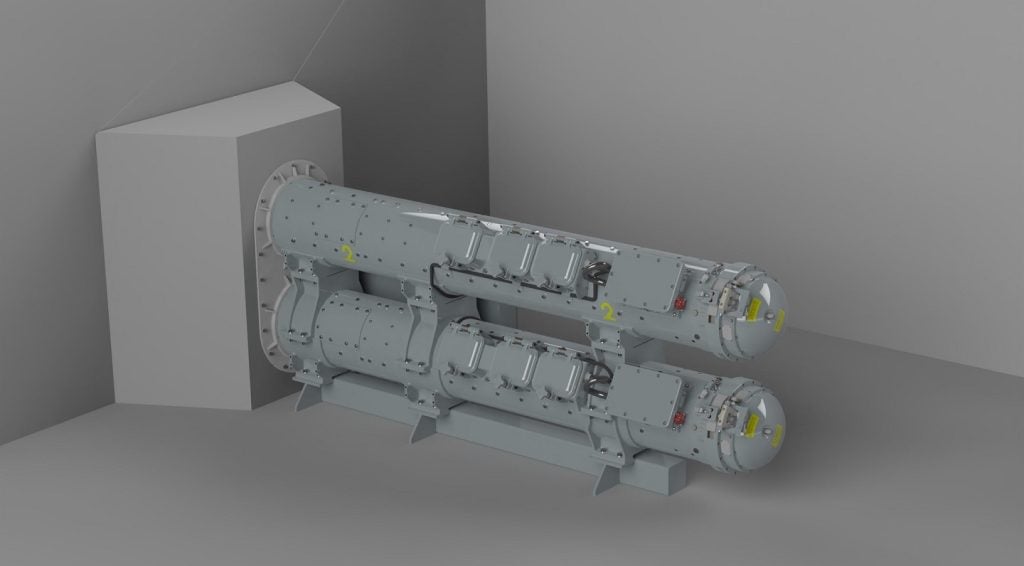

$265m for various munitions and ordnance.

Finally, a $245m contract with maximum potential value of $590m for several key contracts for classified customers.