A key element of Japan’s planned defence budget spending, currently under strain through a national currency devaluation shock, will be the manufacture of two additional Mogami-class frigates, also known as the Future Frigate Multirole (FFM) platform.

Japan earmarked $50bn for defence in 2023, directing substantial investments towards naval vessels and surface combatant development. Despite economic challenges, Japan’s Ministry of Defence (MoD) has proposed a 17.2% increase in the 2024 defence budget.

According to analysis from GlobalData’s latest report, “Naval Vessels and Surface Combatants Market Size and Trend Analysis by Segments, Programs, Competitive Landscape and Forecast to 2033,” Japan’s Mogami-class procurement programme will account for about 10% of the total spending on frigates segment by countries in Asia-Pacific region over the period 2023-33.

Akash Pratim Debbarma, aerospace and defence analyst at GlobalData, stated: “China’s growing maritime influence over Japanese offshore territories and maritime boundaries poses a major threat to Japan’s strategic interests.

“These two new FFM vessels, with their stealth capabilities, will be an important asset for the Japan Maritime Self-Defense Force (JMSDF), not only as an advanced combat vessel but will also act as a potent platform for conducting reconnaissance and surveillance operations in the region.”

Japan already operates four FFMs vessels in its fleet. Even though Japan’s shipbuilding industry has historically proven to be a class of its own, Mitsubishi Heavy Industry’s two new FFMs are likely to be integrated with more advanced equipment and a higher level of automation than the previous FFMs.

Debbarma said that Japan “recognises the importance of modernising its naval forces”, which is driven by its desire to establish territorial claims over the Kuril Islands and Senkaku Islands.

“This is more evident from the fact that, despite the recent economic turmoil in Japan, the country’s policymakers are ensuring that scheduled production of critical naval assets such as the FFM vessels are not impacted. Just like the previous Mogami-class frigates, the latest two vessels will also be likely to be delivered on time,” Debbarma suggested.

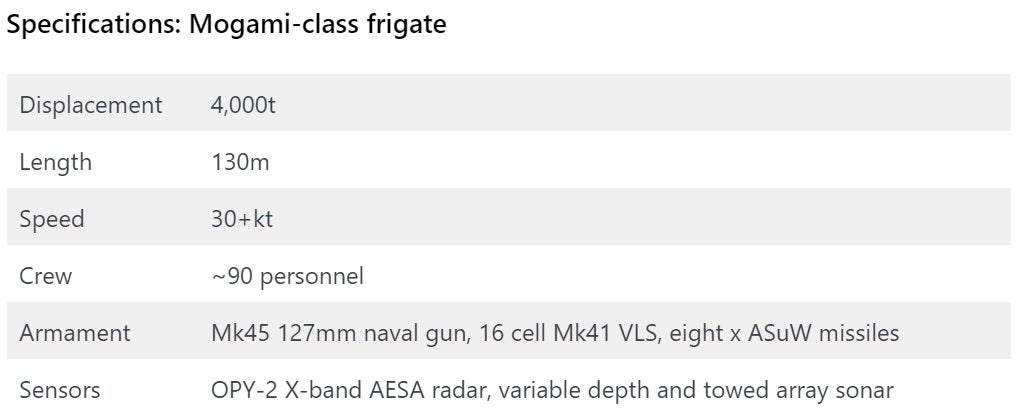

Japan’s Mogami-class frigates

The Mogami class will be a lynchpin of the JMSDF surface combatant force, with the 12-ship fleet intended to replace the ageing Asagiri-class destroyers and Abukuma-class destroyers. The programme was initiated in 2015 when Japan’s MoD allocated funds to analyse the construction of a new compact-type hull destroyer with new radar systems and additional multi-functional capabilities.

The Acquisition Technology and Logistics Agency (ATLA), an arm of Japan’s MoD, launched a new surface vessel programme named 30DX for the JMSDF in August 2017. ATLA selected Mitsubishi Heavy Industries (MHI) as the prime contractor, while Mitsui Engineering & Shipbuilding (Mitsui) was preferred as the subcontractor for the construction of the vessels.

Japan originally intended to build a total of 22 Mogami-class frigates, although this has been reduced to around 12 hulls. Initial plans saw ATLA forecast the first eight hulls to be built at an estimated cost of JPY50bn ($452.7m) a unit.

The first vessel of the class, JS Mogami, was launched at MHI’s Nagasaki Shipyard in March 2021. Mitsui launched the second vessel of the class, JS Kumano, at its Tamano Shipyard in November 2020.

In March 2021, Japan signed a military co-operation agreement with Indonesia to deliver military equipment including up to eight new Mogami-class frigates to the Indonesian Navy.

The third Mogami-class frigate, JS Noshiro, was launched by MHI in June 2021. All the vessels are expected to be commissioned between 2022 and 2032.