US Navy officials in the Surface Fleet Division have approved the life extension of four flight IA Arleigh Burke-class destroyers (DDG 51s) on 3 August.

USS Ramage (DDG 61), homeported in Norfolk, Virginia, and USS Benfold (DDG 65), based in Yokosuka, Japan, have been extended by five years to FY2035 and 2036, respectively.

Likewise, USS Mitscher (DDG 57), also homeported in Norfolk, and USS Milius (DDG 69), homeported out of Yokosuka, have been extended by four years to FY2034 and 2035, respectively.

These extensions follow the March 2023 extension of USS Arleigh Burke (DDG 51) by five years through FY2031. The extension puts each destroyer beyond their estimated service life of 35 years.

“These service life extensions demonstrate the Navy’s commitment to ensuring the surface fleet has the right capability and capacity,” said Rear Admiral Fred Pyle, Director of Surface Warfare. “Adding 23-years of service life cumulatively over the last six months is a significant investment in surface warfare.”

“These extensions align to Secretary of the Navy Del Toro’s commitment to Congress during the FY24 posture hearings to analyse service life on a hull-by-hull basis and extend the correct ships in order to be good stewards of resources invested in the US Navy by the American people,” Pyle added.

This announcement comes following the US Navy contracts awarded to General Dynamics Bath Iron Works and HII to construct nine new flight III Arleigh Burke-class destroyers.

Keeping up with China’s force structure

The approval to extend the life of the navy’s destroyers comes down to maintaining a greater force structure.

“It's right to say that the US is contemplating force size – and maintaining a larger fleet of Arleigh Burke ships is part of the answer,” affirmed GlobalData Aerospace and Defence Analyst, James Marques.

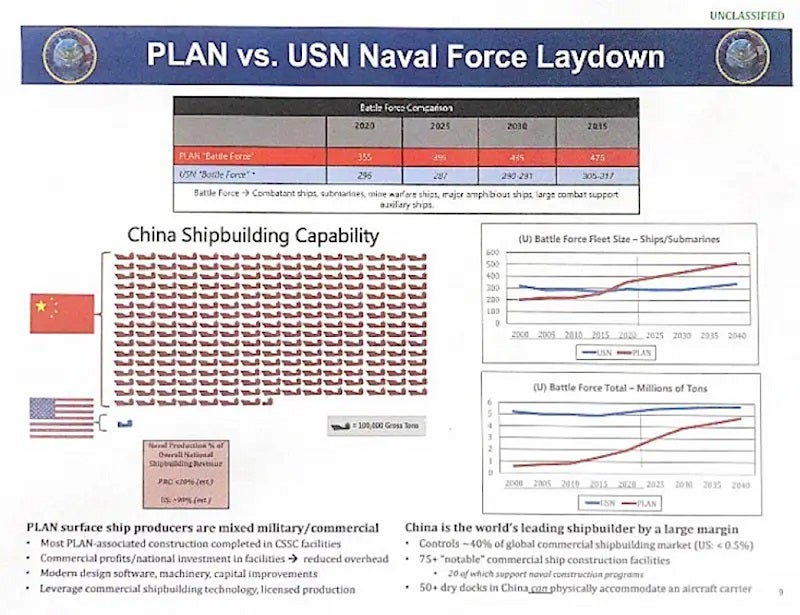

An unclassified government slide visualises the contentious shipbuilding between the US Navy and the People’s Liberation Army Navy.

“This trajectory of spinning up production of a completely new class of destroyers will take some time, but Arleigh Burkes are still good enough in the short-to-medium term,” Marques adds.

It is important for the US to maintain a reasonable ship count while China’s force structure swells. A report from the Congressional Research Service on China’s naval modernisation, published in May this year, reinforces this contention.

“China’s navy is, by far, the largest of any country in East Asia, and sometime between 2015 and 2020 it surpassed the US Navy in numbers of battle force ships (meaning the types of ships that count toward the quoted size of the US Navy).

“The Department of Defense (DoD) states that China’s navy ‘is the largest navy in the world with a battle force of approximately 340 platforms, including major surface combatants, submarines, ocean-going amphibious ships, mine warfare ships, aircraft carriers, and fleet auxiliaries.... This figure does not include approximately 85 patrol combatants and craft that carry anti-ship cruise missiles. The... overall battle force [of China’s navy] is expected to grow to 400 ships by 2025 and 440 ships by 2030.’

“The US Navy, by comparison, included 294 battle force ships at the end of FY2021, and the navy’s FY2024 budget submission projects that the navy will include 290 battle force ships by the end of 2030.

“US military officials and other observers are expressing concern or alarm regarding the pace of China’s naval shipbuilding effort and resulting trend lines regarding the relative sizes and capabilities of China’s navy and the US Navy.”