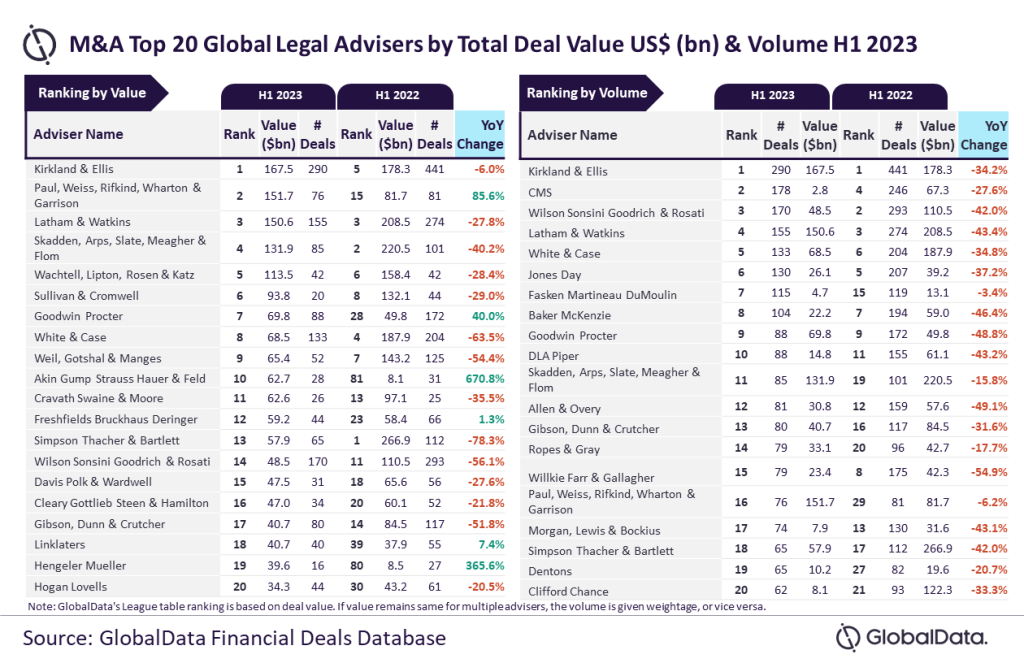

Kirkland & Ellis was the top legal adviser for mergers and acquisitions (M&A) in H1 2023 globally, according to GlobalData’s latest global legal advisers league tables.

The leading data and analytics company ranks legal advisers by the value and volume of M&A deals on which they advised.

According to its financial deals database, Kirkland & Ellis took the leading position in rankings by both value and volume, after advising on 290 deals worth a total of $167.5bn in H1 2023.

“Kirkland & Ellis emerged as a clear winner by volume as it was the only firm to advise on more than 200 deals during H1 2023,” says Aurojyoti Bose, lead analyst at GlobalData. “In fact, Kirkland & Ellis fell short of only 10 deals from touching the 300 deals volume mark thereby outpacing its peers by a significant margin.”

“Moreover, it was also among the only three firms with total deal value surpassing $150bn in H1 2023. Kirkland & Ellis advised on 40 billion-dollar deals [deals valued at equal to or more than $1bn], which also included three mega deals valued more than $10bn. Involvement in these high-value transactions helped Kirkland & Ellis top the chart by value as well.”

GlobalData’s deals database reveals that Paul, Weiss, Rifkind, Wharton & Garrison occupied the second position in terms of value by advising on $151.7bn worth of deals, followed by Latham & Watkins with $150.6bn, Skadden, Arps, Slate, Meagher & Flom, Meagher & Flom with $131.9bn, and Wachtell, Lipton, Rosen & Katz with $113.5bn.

The runners-up in terms of volume were CMS with 178 deals, followed by Wilson Sonsini Goodrich & Rosati with 170 deals, Latham & Watkins with 155 deals, and White & Case with 133 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.