The US Navy is unable to provide a full cost and schedule estimate for its ongoing Shipyard Infrastructure Optimisation Programme (SIOP) – an effort to improve its dry docks, facilities, and equipment—and reports that it will not be able to do so until 2025.

The US Government Accountability Office (GAO) published a report on 28 June detailing the mistakes the navy has made since the beginning of the programme in 2018.

Specifically, the navy conducted important sensitivity, risk, and uncertainty analyses on a preliminary design but did not update them to reflect the final design. In addition, the navy did not document that it used different methods to estimate high-value cost elements to cross check its calculations, a best practice assuring reliable cost estimates.

Without performing and documenting cost estimating best practices for current and future key SIOP projects, the navy would be at risk for increased costs and schedule slippages resulting from unexpected design complexity, incomplete requirements, and other uncertainties.

In the mean time, the navy will provide an annual updates of the estimates costs of SIOP projects it intends to undertake during the next five years, by which time each shipyard will have completed their detailed infrastructure plans identifying specific facility projects.

SIOP's unceasing costs

In 2022, the navy completed its first plan for Pearl Harbor Naval Shipyard. The estimated cost increased from an estimated $6.1bn in 2018 to $16bn in 2022.

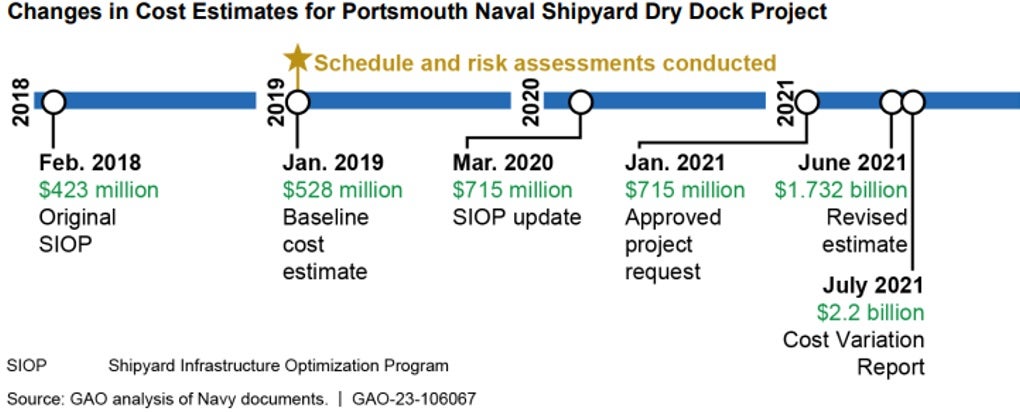

Meanwhile, the Portsmouth dry dock is the first and only key SIOP project underway as of January 2023.

In its 2023 five-year plan, the navy estimated it would cost $3.6bn for the dry dock project at Pearl Harbor and $2.2bn for the dry dock project at Portsmouth. As of March 2023, the navy received $1.6bn for these projects and requested, or planned to request, an additional $4.2bn.

Sustaining future vessels in the next decade

The US is currently undergoing a comprehensive modernisation effort. GlobalData says that the global naval vessels and surface combatants market is expected to be led by North America, with a revenue share of 35.7%. The region’s spending is projected to be dominated by the US over the forecast period. With the hike in the US defense budget, the North American region is expected to offer significant opportunities for shipbuilders and sub-system vendors across the globe.

Submarines are the second largest sector by the forecast value, with a cumulative market value is $74.5bn, with a positive CAGR of 3.2%. There are three ongoing programs that will continue into 2022–27. These are the acquisition of the Columbia-class SSBN and Virginia-class SSN, and the Shallow Water Combat Submersible MK XI.

The GAO previously found that the condition of the naval shipyards is poor. The navy's capital equipment is past its useful life, which led to the SIOP investment strategy in 2018, to be implemented in the next two decades.

With cost mismanagement and schedule delays a persistent problem, the navy will be unable to fulfil these ambitious programmes in the next decade as industrial capacity will fall far behind the appropriate level needed at unreasonable costs and timelines.