Aerojet Rocketdyne, a major propulsive systems supplier, has agreed to team with the US Naval Surface Warfare Center’s Indian Head Division (IHD) – the US Navy’s premier explosive ordnance facility based in Maryland - to maximise solid rocket motor production.

According to a statement issued on 8 January 2024, the provider said “we’re increasing our production capability to meet today’s growing demand and to prepare for any surge in support of near peer conflicts.”

The company refers to global conflicts against near-peer aggressors such as Russia and China, both of whom reject the US-led ‘Rules Based Order.’

Ukraine’s war against the Russian invader, which began nearly two years ago, demonstrates the importance of solid rocket motors - a military component that provides propulsion to a range of weaponry.

Ukraine is experiencing a shortfall in all forms of rocket artillery - from HIMARS to Javelins and Stingers - and is increasingly relying on loitering munitions and uncrewed aerial vehicles instead, according to a report from The Wall Street Journal. Ukraine's depletion serves as warning to the US and its allies for producing an appropriate level of these systems and solid rocket motors.

GlobalData Defense Analyst Wilson Jones notes: “They’re essential for any rocket system, whether that’s a military missile or sending a satellite into orbit. There aren’t many companies that make them, and Aerojet was one of only a few in the US. Not surprisingly, it’s very difficult and expensive to enter this industry – it is literally rocket science.”

This ten-year arrangement lays the foundation for an innovative public-private partnership that establishes a pathway for the IND to become a qualified partner with Aerojet Rocketdyne to perform certain motor manufacturing processes.

Arming US Navy deterrence

In its Global Missiles and Missile Defence Systems report, the intelligence consultancy GlobalData anticipates that the commissioning of next-generation military platforms such as guided missile frigates, destroyers, corvettes, and submarines will increase the demand for their weapons payloads, especially missiles.

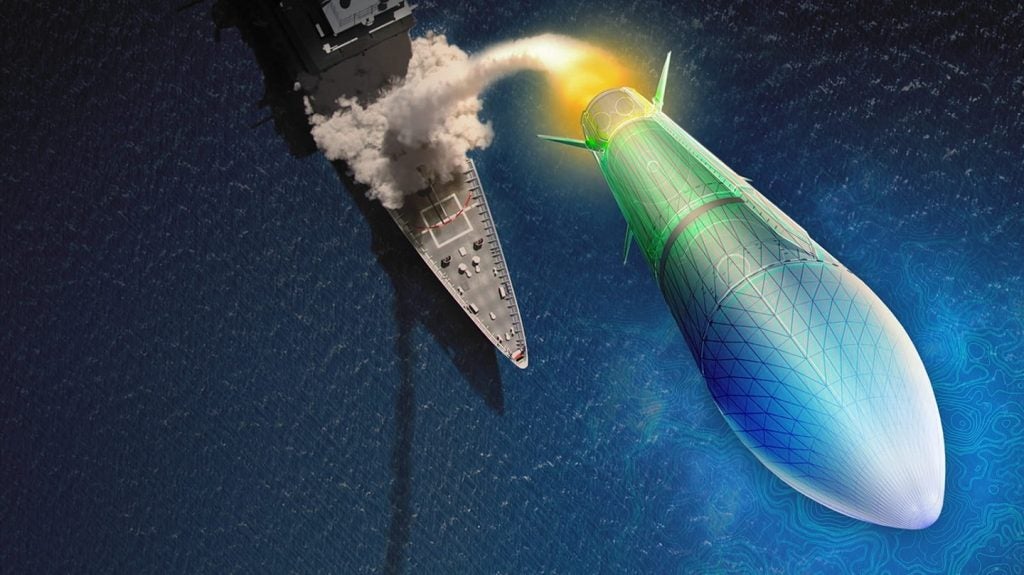

The US Navy’s Conventional Prompt Strike (CPS) programme is the naval variant of the US Army’s Long Range Hypersonic Weapon, which is developing independent launch solutions to deliver a booster armed with the Common - Hypersonic Glide Body projectile. In September 2023, plans were made to integrate the CPS to the Navy’s largest and most advanced destroyers, the Zumwalt-class (DDG 1000).

Likewise, in November 2022, the US Navy reported that China’s Type 094 ballistic missile submarines (SSBNs) have been re-armed with the JL-3 missile, which can reach between 9,000-10,000 kilometres and thus targeting the US mainland from a greater distance.

Surging demand for solid rocket motors

“It’s not so much that supplies have depleted inventory but rather that the Ukraine conflict has highlighted the lack of capacity and scale in manufacturing,” Tristan Sauer, another GlobalData Defense Analyst, described.

The US prime, L3Harris Technologies, recognised the capacity shortfall in producing solid rocket motors. In July last year, the company acquired Aerojet Rocketdyne to remedy the problem.

“That was arguably one of the smartest and most important long-term merger and acquisition deals of the last decade,” Sauer argued.

“It will undoubtedly help alleviate lacking capacity over the medium to long term as L3Harris is a prime which can leverage a lot of capital, expertise and industrial capacity to scale up Aerojet’s activities.

“But these things take time and we’re always building today for yesterdays’ war while today’s war requires something different.”