The protection of undersea infrastructure and securing key subsurface capabilities has never been more critical for European countries, amid increasing instances of suspected sabotage by ‘unknown’ actors in regional waters.

Such instances first began to make headlines with the Nord Stream pipeline sabotage in September 2022, among nearly two dozen such pipes that connected European economies with Russia’s natural gas resources.

The incident came as European countries sought to increase their support to Ukraine, following Russia’s large-scale invasion of its neighbour in February of that year.

Other incidents include damage to the Balticconnector gas pipeline that connects Finland and Estonia in September 2023 by China, which was labelled an accident by Beijing. In late-2024, Sweden began investigations into damage caused to undersea internet cables caused by a China-flagged vessel.

To this end, European countries have increasingly sought to further undersea monitoring and surveillance, via surface and subsurface platforms, such as diesel electric submarines and uncrewed surface vessels (USVs).

Europe’s submarine market

The global submarine market, valued at $40.1bn in 2025 according to the latest analysis conducted by GlobalData, is expected to reach $65.9bn by 2035.

Europe is expected to account for nearly 25% of the market, indicative of the considerable levels of spending on subsurface capabilities from the continent’s navies.

While the majority of this spending is being committed by France and the UK on strategic nuclear-powered submarine programmes, other European navies have embarked on a number of conventionally powered submarine acquisition efforts.

Platforms like the Type 212CD submarines are in high demand, with Germany announcing in December 2024 that it would order an additional four boats on top of two earlier agreed, in a joint programme with Norway now due to build ten vessels in the coming years.

In addition, other designs such as the Sweden’s Blekinge-class submarines are also under construction, which will be ideally suited to intelligence operations and the monitoring of subsurface threats in the Baltic Sea.

An earlier 2023 report by GlobalData found that non-nuclear submarine programmes were benefitting from developments such as Air Independent Propulsion (AIP), enabling conventional propulsion to keep the boats submerged for longer than previously possible.

Usually smaller, conventionally powered submarines were typically seen conducting intelligence missions in the littorals waters and supporting special forces operations.

Europe’s USV leaders

Meanwhile, USVs also look set to play an important role in European maritime security, with the benefits of increased endurance and time on station offering advantages over crewed platforms.

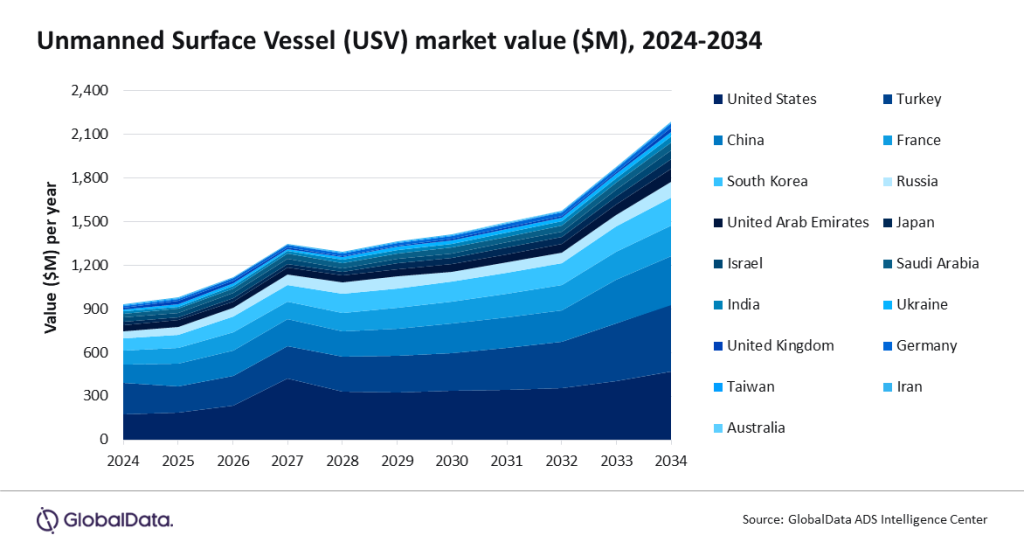

Further GlobalData analysis conducted in mid-2024 forecast the global USV market would more than double to $2.5bn by 2024, although much of the development will be around combat platforms as seen in the Ukraine-Russia war.

In addition, France and Türkiye are expected to be major USV players, in addition to the likes of the UK and Sweden. Türkiye alone is expected to increase spending on USV from $214.1m in 2024 to $459.9m in 2034.

It is estimated that more than 40 countries around the world will operate USVs by 2034, conducting missions such as subsurface surveillance, mine countermeasures operations, and other intelligence tasks.

Undersea Defence Technology is Europe’s leading show dedicated to subsurface defence operations. For more, visit the show website here.