For the Ukrainian troops on the frontlines, few ballots in this so-called ‘year of elections’ will be more consequential than the European Parliament vote this week.

The ramifications of a Trump versus Biden presidential victory in November have understandably grabbed headlines, but the outcome of the European Parliament elections, which run from tomorrow (6 June) to Sunday (9 June), will hold significant sway over two key factors in the Russia-Ukraine war: frozen Russian assets and Ukrainian ammunition supplies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBoth issues have taken on a sense of renewed urgency as Russian forces open a new front near Kharkiv in northern Ukraine and with Moscow’s full-scale invasion showing no sign of relenting.

Whichever party wins the European Parliament elections will play a pivotal role in Ukraine’s fate, for which reason President Zelensky and the Ukrainian forces will be watching on with bated breath – analysts are predicting that anti-European populists will top the polls in nine member states amid a major shift to the right.

The rise of the right – what does it mean for Kyiv?

Within the European Parliament, the overarching threat to the Ukrainian war effort lies in the far-right Identity and Democracy (ID) group.

Founded by French politician Marine Le Pen in 2019, ID is made up of nationalist, populist and Eurosceptic parties with sympathetic views towards Russia.

In Strasbourg, ID is led by Italian politician Marco Zanni – a representative of the openly pro-Russian, right-wing Lega Nord party. Right-wing populist party Alternative for Germany (AfD), allegedly funded by Moscow, was also part of ID until it was rejected last month after lead candidate Maximilian Krah said Nazi SS officers were not all automatically “criminals”.

Fears of ID’s intentions in Ukraine linger, but the group only holds 49 of the European Parliament’s 705 seats.

With this number due to rise to 720 seats after this week’s elections – the second-largest democratic electorate in the world after the Indian Parliament’s surprise election result yesterday (4 June) – ID will have to significantly increase its share in the European Parliament to pull out of pro-Ukraine initiatives.

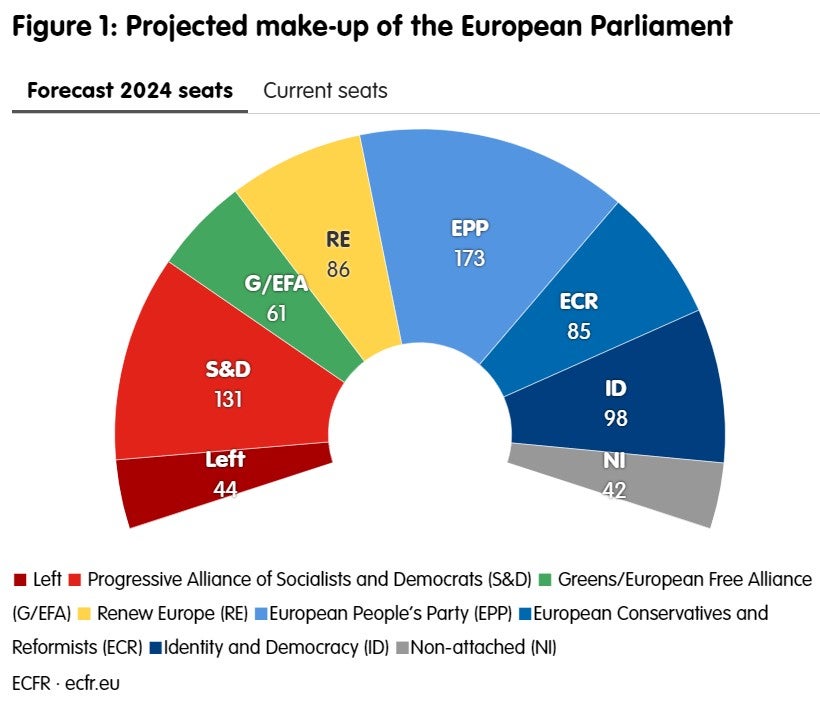

But ID’s number of MEPs is predicted to double after this week, according to forecasts by the European Council on Foreign Relations (ECFR).

This would make ID the third most powerful group in Strasbourg, overtaking the largely pro-Ukraine groups of Renew Europe (RE), the European Conservatives and Reformists (ECR) and the Greens/European Free Alliance (G/EFA).

The same forecast predicts the European People’s Party (EPP) will remain the EU’s largest group with a slightly diminished 173 seats, led again by European Commission President Ursula von der Leyen.

With a majority of at least 353 seats needed, von der Leyen faces increasing pressure to secure a coalition alliance. In April, she set out three conditions for any potential partners: they must be “pro-Ukraine, pro-NATO and pro-EU”.

ECR has expressed continual support for Ukraine. The likeliest outcome on Sunday (9 June) is a centrist-right coalition between the EPP, ECR and one or two other groups – while pro-Kremlin ID Group will command larger attention in the European Parliament’s debates over supplying weapons to Kyiv.

Should the EU use frozen Russian assets to finance Ukraine’s war effort?

Once the new European Parliament is formed, one of its most pressing early decisions will be how to maintain funding for Ukraine’s war effort.

As the US looks to delegate support for Ukraine onto its European Nato partners and focus on geopolitical fronts in the South China Sea and Middle East, the question of whether or not to fund Ukraine’s defence – and eventual reconstruction – using frozen Russian money resurfaces.

This week, the EU “finally took a definitive decision”, says Christopher Granville, managing director of global political research at TS Lombard.

“All interest earned from March 2024 onwards on the Russian Central Bank’s reserve assets frozen in Euroclear (roughly $198bn) will be appropriated by the EU and 90% of the proceeds will be channelled through the EU’s ‘Peace Fund’ to purchase weaponry for Ukraine,” Granville tells Army Technology.

At the insistence of Ireland, Austria and other neutral EU member states, the remainder of the interest accrued will be used to fund Ukraine’s reconstruction and humanitarian supplies.

A small amount will also be kept in reserve to cover Euroclear’s costs – “including legal costs in the likely event that Russia litigates”, Granville adds. Despite the vast amounts involved, the total is expected to be a comparatively modest $4bn this year.

Most European Parliament groups are in favour of the plan, described as “definitely appropriate” by Peter Dickenson, Ukraine analyst at the Atlantic Council.

However, such a strategy has drawn criticism from a moral, legal and financial perspective – not to mention provoking a backlash from President Putin.

“A very clear and transparent legal framework needs to be established that explains why this is justified and on what grounds,” Dickenson tells Army Technology. “I have not seen that yet. With such a legal basis, the risk is that the West will lose credibility as a reliable financial partner, which could lead to a further weakening of the West’s global position over time.”

Granville believes the EU has mostly covered its tracks but should be ready for a strong Russian response – financially and militarily.

“This decision is clearly designed to keep on the right side of the Rubicon in the sense of not confiscating the underlying Russian assets themselves, but instead just impounding the returns on those assets which amounts to a form of windfall taxation,” Granville concludes. “The most obvious Russian retaliation would be to impound the dividend income received by international investors from ‘unfriendly’ (i.e. sanctioning) jurisdictions on their holding of Russian securities. These dividend proceeds are now frozen on so-called “S”-accounts in banks inside Russia and they total around $350m.”

Should ID Group bolster its MEP ranks once the vote count is in this Sunday (9 June), its Kremlin-sympathetic members are expected to denounce the frozen Russian assets plan.

With the wheels already in motion, ID will struggle to stop such a strategy. But will it become a bellwether for future division over supporting Ukraine in an increasingly fractured, rightist European Parliament?