As another UK warship is set to be consigned to the breakers yard with former Type 23 frigate HMS Monmouth now destined to be torn up at Turkey’s Leyal Ship Recycling, the apparent absence of UK shipyards in providing a sovereign ship recycling capability is notable.

The award to a Turkish shipyard on 8 April is the latest in an ongoing trend to contract the recycling of UK warships overseas, with Type 22 frigate HMS Cornwall the last to be broken down in-country, more than a decade ago.

Extensive research carried out by Naval Technology through analysis of formal documentation of the recycling contract process, from the award of preferred bidder status through to signing, has shown the dominance that Turkey’s ship recycling industry has when the UK comes to scrap its old warships.

Announcing the contract to recycle decommissioned Type 23 frigate HMS Monmouth, the UK Ministry of Defence (MoD) said on 8 April the vessel would be broken down in Turkey by Leyal Gemi Sokum Sanayi Ve Ticaret Ltd Sti (also known as Leyal Ship Recycling).

The UK MoD stated that expressions of interest were requested from recycling yards on a “European list of ship recycling facilities” and, after a “robust tender process and evaluation”, the award was made to Leyal.

UK warship recycling – a clear trend

Following investigation of historic UK warship recycling contract awards, of 29 Royal Navy’s most recent major surface combatants from the Type 22 and Type 23 frigate classes, the Type 42 destroyers, as well as the three Invincible-class aircraft carriers, it can be determined that 18 vessels have been sold for recycling to Turkey.

Just eight of an original class of 16 Type 23 frigates are still in service with the Royal Navy. Of the original 16, three vessels were sold to Chile in the mid-2000s and of those in UK service, five have been decommissioned.

Of the five decommissioned Type 23s, three were axed in 2024 alone as the UK government sought to cut costs, with the frigates increasingly expensive to maintain. If the decision is made to scrap these vessels, where this work will be performed will be of interest.

The exact expected out-of-service dates (OSD) for the remaining Type 23 frigates is guarded by the UK Ministry of Defence, although vessels were last known to be scheduled to leave service through to 2035, the last being HMS St Albans, the newest Type 23, commissioned in 2002.

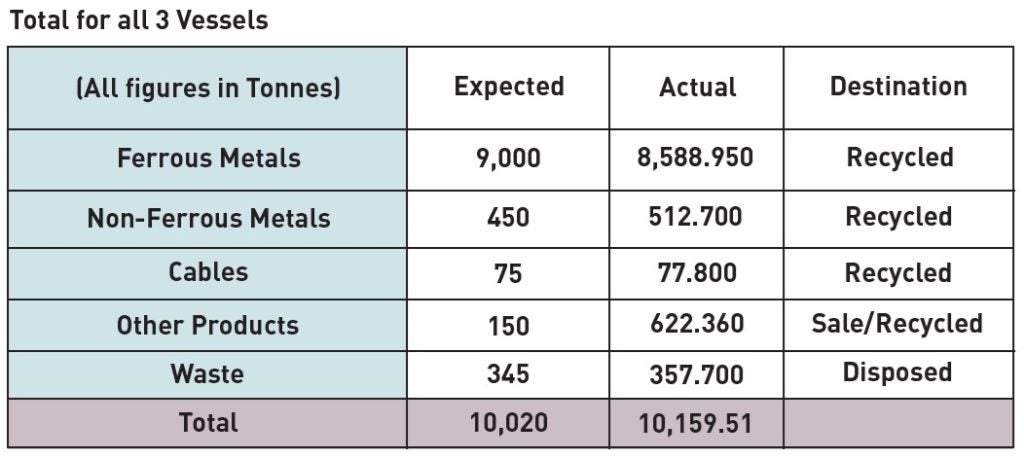

This is not to say that Leyal is not efficient in its ship recycling work, as reports from the MoD’s Disposal Services Authority points out, citing the example of the breakdown of former Type 42 destroyers HMS Edinburgh, HMS Gloucester, and HMS York, in the mid-2010s.

“It took just seven months to dismantle and recycle the three vessels with 96% of the vessels recycled,” the report noted.

Indeed, additional Type 42 destroyers were recycled at more than 97% efficiency, with Leyal required to provide monthly updates, including photos, to document the work being done.

What about rules to include UK yards?

According to a 2021 note published by the UK Maritime and Coastguard Agency, since 1 January 2021, it has been a requirement for UK ships to be recycled at a facility which is on the UK List of approved ship recycling facilities.

Official UK ship recycling regulations require the publication and maintenance of a list of official ship recycling facilities which are located in the UK and authorised “in accordance with retained UK regulation”.

A wider non-UK list is also maintained, including sites at both European Union (EU) and non-EU countries.

As of December 2022, the UK List included the following UK-based ship recycling companies: Kishin Port (Exp April 2026); Swansea Drydocks (exp July 2025); Inchgreen Dry Dock (exp October 2026); Harland & Wolff (exp June 2025); Dale Marine Services (exp November 2022); and Able UK (exp October 2025).

Naval Technology reached out to a number of UK shipyards to enquire about contracts to recycle UK warships, finding that in some cases sites had determined to divest their ability to break down naval vessels.

One shipyard source said that the MoD had previously said it would look to contract the majority of UK warship recycling to UK sites, but the reality was that this “never happens”.

However, it is also understood that no UK shipyard tendered for the Monmouth recycling contract.

The exact reasons for this are unclear, but it does point to an apparent lack of engagement between UK shipyards and the MoD, through its Defence, Equipment and Support (DE&S) Exports and Sales.

Common in UK defence procurement – the opposite side to decommissioning and sales area being analysed here – is contract weighting for national participation, whether it be in manufacture or assembly. For example, a national weighting scale is public knowledge for the UK’s planned New Medium Helicopter programme.

Other examples too highlight the role that UK industry has been given, even when contracts are given to non-UK entities, such as the Boxer and Ajax procurements in the land domain.

This has become even more important UK defence programmes, as the UK government seeks to harness provable economic benefits when committing hundreds of million, or billions, of pounds to an acquisition. The potential economic boost to sovereign aerospace capabilities in determining whether to invest in new Eurofighter Typhoon or F-35 fighters has been of keen interest, as has the role that the GCAP programme will have in boosting jobs across the country.

With the UK set on developing an ability to – finally – dispose of its plethora of decommissioned nuclear-powered attack and ballistic missile submarines, the lack of any national plan for surface warships is apparent.